“I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody.”

Democrat political strategist James Carville made that observation in reaction to a bond market revolt in 1994 against the profligate spending of the then-President Bill Clinton. Thankfully for the new president and for the country, Clinton acquiesced to the bond market and thereafter pursued reasonable budgets that helped spur tremendous prosperity into the last half of the 1990s.

Well, the current bond market revolt against Joe Biden makes that 1994 version look tame by comparison. Even worse, this present toxic stagflation combination -- soaring inflation/interest rates plus a troubled growth trajectory – produces untold pain throughout the economy, including new risks for the banking sector.

Silicon Valley Bank failed last week and was seized by state regulators in California and placed into the control of federal regulators. SVB is the 16th largest bank in America and the largest bank collapse since the Great Recession of 2008-09.

Some of the predicaments of SVB are peculiar to that institution, especially its dangerous, concentrated dependence on the Tech space. Looking at the broad economy, Biden’s economic crisis grips consumers and sends major industrial metrics deeply into recession territory, such as Purchasing Managers Indices.

Tech Troubles for Silicon Valley Bank

But even as those barometers tank, the pain has been more acute in Tech. The sector thrived like never before during the lockdowns as Americans were forced into lives dominated by screens and online shopping. These unscientific and ineffective lockdowns were, not surprisingly, reinforced by the very same Tech oligopolies reaping the benefits of the repression. For example, Google, Facebook, and Twitter all censored and diminished content that was skeptical of these tyrannical lockdowns and mandates.

But now, with the economy decelerating and Biden’s inflation biting, Tech faces a very different landscape. Since the beginning of 2022, over 150,000 Tech workers have lost their jobs, and the pace of the layoffs currently accelerates. Not surprisingly, the stocks of Big Tech have similarly flailed, as shown here:

Amid this pain, SVB depended too much on one sector, clearly. As the carnage spread in Tech, so too did the withdrawals from SVB customers. These once-flush individuals and firms scrambled for cash and created material stress upon SVB. But, that stress could have been manageable, except for the additional pain of the bank’s bond portfolio.

Trouble in Treasuries

In standard portfolio construction, bonds are generally regarded as the steady but boring components. Within the world of bonds, US Treasuries occupy the highest rung of credit quality and, in normal times, the very definition of staid, “risk-free” holdings, because the US Government pays back its debt.

But, since 2021, with the biggest explosion in inflation in four decades, the near-term volatility of Treasuries rocketed higher. Consider, for example, that a Two-Year Treasury note started the Biden administration with an interest rate near zero. Even though the post-pandemic economy was roaring back to life, during the “Trump Boom 2.0,” inflation was negligible. As Biden took office in January of 2021, Two-Year Treasury Yield stood at 0.13%. But last week…2 Year Yield hit 5.00%, the highest level since 2007. That rapid ascent of short-term rates -- almost 40 times higher than just 26 months ago – produced a meltdown in Bond prices throughout 2022.

Bond prices move inversely to yield. So, as interest rate soared, bond prices collapsed. Longer-term Treasuries lost 18% in 2022, the worst year ever — and nearly doubling the losses of the second worst year ever.

How stable are Treasuries normally?

Well, over the last century, T-Bonds only lost 1% or greater in 16 years total out of 100, per data compiled by the NYU Stern School of Business. Even worse, bonds got clobbered in 2022 concurrent with stocks, an incredible rarity in capital markets. In a normal business cycle, when capital markets function properly, a terrible stock year like 2022 compels a “flight to safety” demand for bonds. Consequently, investors expect bonds to act as effectively insurance against more volatile equity holdings.

Volatility

But in the age of Biden, economic and legal precedents get shattered. So, not only did bonds fail to provide safe harbor from turbulent markets – instead bond added to the volatility and the losses. Massively so.

For example, in the last century there are only 9 prior instances of Treasury Bond losses of -2.5% or more for a year. In 8 of those 9 years, though, bonds traded modestly lower in price as stocks soared, meaning that the traditional asset-blend approach worked. Specifically, in those 9 years of bond losses, the average gain in the S&P was a superb +17%.

But last year, bonds got crushed right alongside stocks. There was nowhere to hide in Biden’s created economic crisis.

SVB’s Quandary

So, as redemptions and withdrawals accelerated across the Silicon Valley region and the bank, SVB faced a fatal death spiral. To meet its obligations, the bank was compelled to sell Treasury holdings that had been crushed in value, thanks to soaring inflation. As rumors mounted and depositors got nervous, the withdrawals accelerated and, so too, did the need to sell more bonds at a loss. As such, the institution that was once revered as a pillar of Bay Area business -- collapsed within days.

Fallout

How broad is this problem, especially for regional banks? The stockholders of these firms show little willingness to wait and see, as the shares of SVB-type firms across America have been aggressively marked down in recent days. Here is an ETF (exchange traded fund) of the sector, a basket of regional banks trading under the ticker KRE. This near-term chart shows just how tumultuous recent weeks have been for these businesses across America:

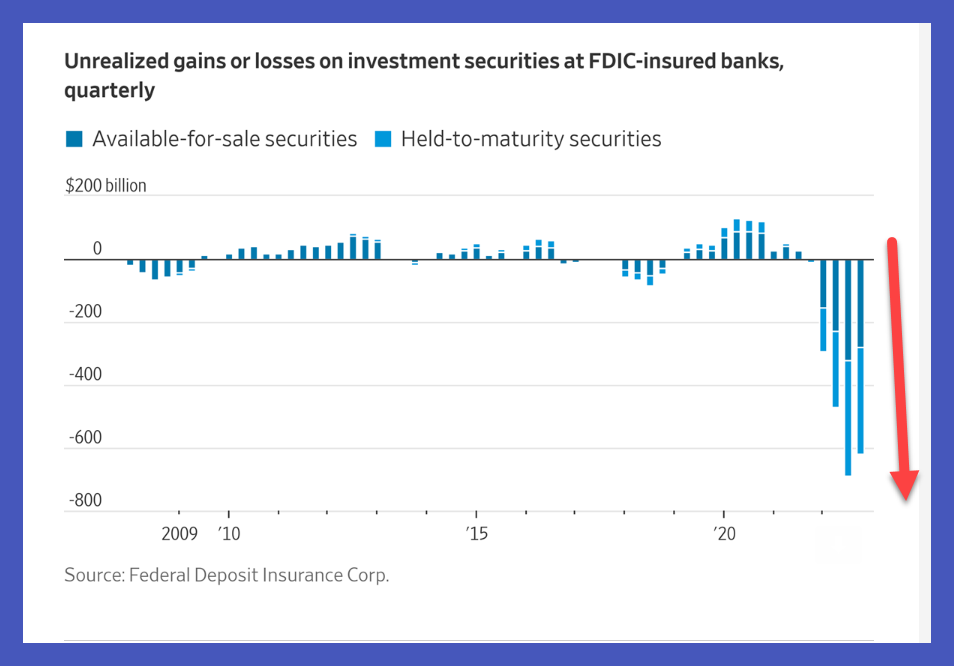

Most of these banks do not face the same industry-concentration risks of SVB. But nearly all of them confront very similar issues with toxic asset holdings, bonds once considered safe and stable that now bring uncharted risks. This chart from the Federal Deposit Insurance Corporation itself highlights those risks:

As this graph depicts, the era of Biden brings unprecedent risks and calamity. Will SVB be contained? Time will tell – but there is rarely “only one” cockroach…

I'm sure there must be umpteen and a half other ways of saving our country...but...being a prosecutor I only see one: supporters of Kari Lake need to organize massive, nationwide street demonstrations for the purpose of forcing the Supreme Court to overturn the fraudulent Arizona election [something this supernaturally lazy court isn't inclined to do absent enormous public pressure]. Previous courts have done the hard work of reviewing briefs "bristling with facts" regarding taxes, school districts, voting precincts, etc. Justice Roberts [America's "40 Year Old Virgin" lookalike] doesn't want to get his baby hands dirty ---so he has to be pushed. The results of a serious look at the voting irregularities In Arizona will make it crystal clear 2020 was stolen too. This will hand MAGA republicans the card they need to commence dead serious impeachment proceedings.

Biden ---and all the crap that accompanies him ---needs to be brought down before 2024. Let's get the ball rolling by compelling the do-nothing Supreme Court to acknowledge we aren't presently operating under a legitimately elected government.

I agree there are more SVB cockroaches. Yet our Treasury Secretary Janet Yellen in February was over in Ukraine glad-handing $1.25 billion to Zelensky as part of a $9.9 billion bag of U.S. taxpayer dollars. If Ukraine can’t track the arms we are sending, this much more fungible gift for ‘schools and emergency personnel’ will surely evaporate. When asked about difficulties in our country Yellen has fuzzy comments like, “We are monitoring the situation.” Or a loose interpretation; we are doing nothing and haven’t a clue. With all we are facing and will be facing, I’m of the opinion we should have a priority over the money the Biden administration is giving their band grifter pals in Ukraine. Here we are, let’s see what happens with all that ‘monitoring’ when more cockroaches bolt out of the cracks in the banking system.