Biden Crushes Banks, But Saves Venture Capital

Cronyism abounds, and regular Americans owe zero to Silicon Valley

The moguls of Silicon Valley largely installed Joe Biden into the White House. But the man they coronated has turned into a disaster for their enterprises. The pain of Biden’s created economic crisis afflicts all of America, of course…but Tech has been hit first and hardest.

Now, many of those same Tech titans practically beg for public assistance to bail out their investments and deposits as banks flail because of the runaway inflation created by their chosen man. Specifically, venture capital firms clamor for guarantees from regular taxpayers to cover the losses - or potential losses - of their favored banks.

For years, these venture capital firms have successfully projected a public image of daring dreamers who provide the investment jet fuel to propel American innovation. For a time, that image reflected reality, to be sure.

But today, like so many formerly bold institutions of American life, VC descends largely into a rent-seeking space of connected, credentialed cronies who leverage their access to transform leftist public policies into private profits.

With some notable exceptions, these predictable and formulaic VCs have generally provided poor risk-adjusted returns to investors. Even worse, now that these venture firms and their connected companies feel the full wrath of Biden’s economic failures, the industry clamors for bailouts from regular Americans.

Venture Capital Then and Now

In the mid to late nineties as the internet came into ubiquity in American life, the VC industry flourished with smart early investments in firms that dominate American business to this day. Among these giant VC home runs were: Amazon, Google, eBay, Facebook, PayPal, and Netflix.

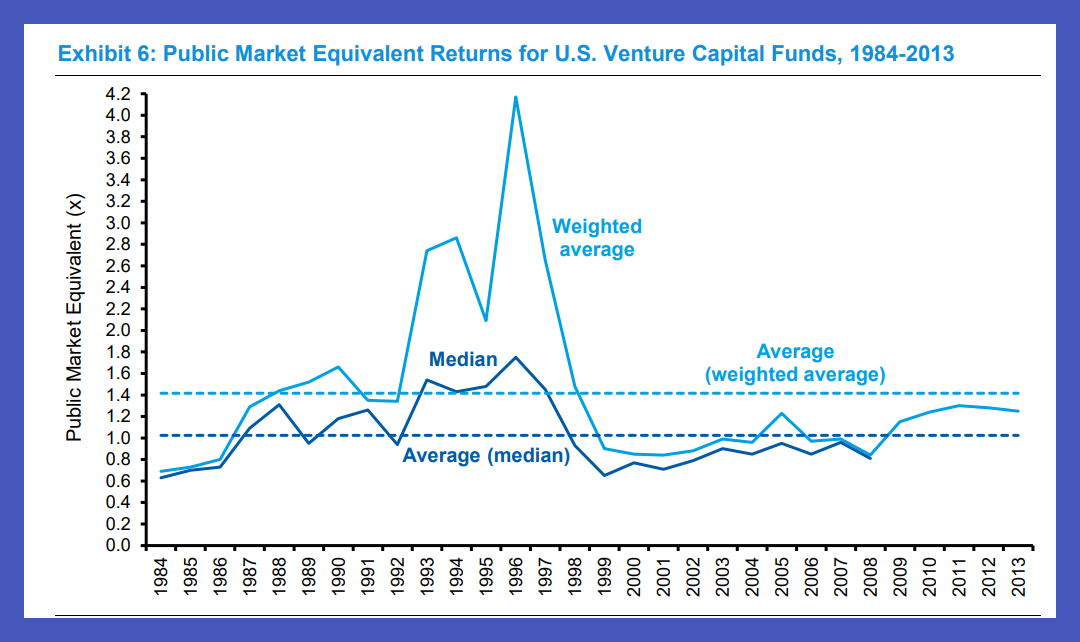

But since the 1990’s, despite massive investment inflows into VC and an elevated public profile for the industry, returns have disappointed overall. Consider this Morgan Stanley 30-year chart of investor gains in VC for the 3 decades from 1984-2013.

Bringing the analysis to the present day, 2022 was simply a disastrous year for VC as the investors suffered the broad pain across Tech. For the year, total “exits” from investments totaled only $71 Billion, which represented a whopping 90% decrease from the torrid pace of 2021. The year 2022 also marked the first year since 2016 with that figure below $100 Billion. Even worse, the pace of successful exits plunged into year end, setting a terrible trendline into this year 2023.

So, after the big successes of decades ago in VC, more recent returns disappoint. As the FT recently observed: “the venture capital index looks roughly like the average of the last five quarters of the public market benchmark.” Given the outsize risks of VC, this lack of longer-term outperformance is damning.

Politics partly explain the VC hurdles and overall Tech meltdown in two ways. First, Biden’s inflation smashed prosperity for nearly all of America, but most acutely for the previously highest-flying sectors in Tech. After all, the unscientific and tyrannical lockdowns created a Nirvana-like world for many Tech firms, with Americans trapped in their homes, living on screens and shopping virtually. But the bill for the attendant fiscal profligacy came due, and it walloped Tech first and hardest.

Second, VC’s fixation with politically correct investments proves disastrous. The ESG space, for example, is simply too crowded and devoid of profits. But VCs piled in, nonetheless, for political reasons. As Axios reported last year “venture firms investing solely in climate technology are driving the majority of deal activity in the industry.”

These firms that rushed into politically-motivated “green” technology to align themselves Permanent Washington and the corporate media. Now that so many of these bets tank, in large part because of Biden’s inflation, the VC firms turn to the public for funds. But should a working single mom waitress in the California Central Valley guarantee the commercial account of a venture firm at Silicon Valley Bank?

Moreover, how many more SVB situations lie in waiting?

Right now, PacWest teeters, another bank with a substantial VC customer base. The Beverly Hills bank lost nearly $7 Billion in deposits in recent weeks -- with 72% of the withdrawals emanating from venture firms. The shareholders of PACW do not seem anxious to wait around for answers about the bank’s health. Here is the chart: