Biden Rewards Big Business, Crushes Small Firms

Permanent Washington works hand-in-glove with Big Business

It’s “a tale of two cities” for many stock investors…or rather, two markets.

The big guys crush it lately, and the smaller players get, well, even smaller.

Biden, Democrats, and collaborator Republicans of the political class in Washington create policies and incentives that send windfall gains to the biggest existing mega-cap multinational winners, to the detriment of the upstarts and the strivers.

For example, Big Energy has soared throughout the Biden tenure in the White House, as his war on new drilling and expanded pipelines sends outsize rewards to the existing giant conglomerates, who benefit mightily from Crude Oil prices sustaining the $80’s, compared to the lower $40’s when Biden took office. The ETF (exchange traded fund) basket of the largest oil companies, XLE, has doubled since Biden took office, rising from $43.77 to above $86/share presently.

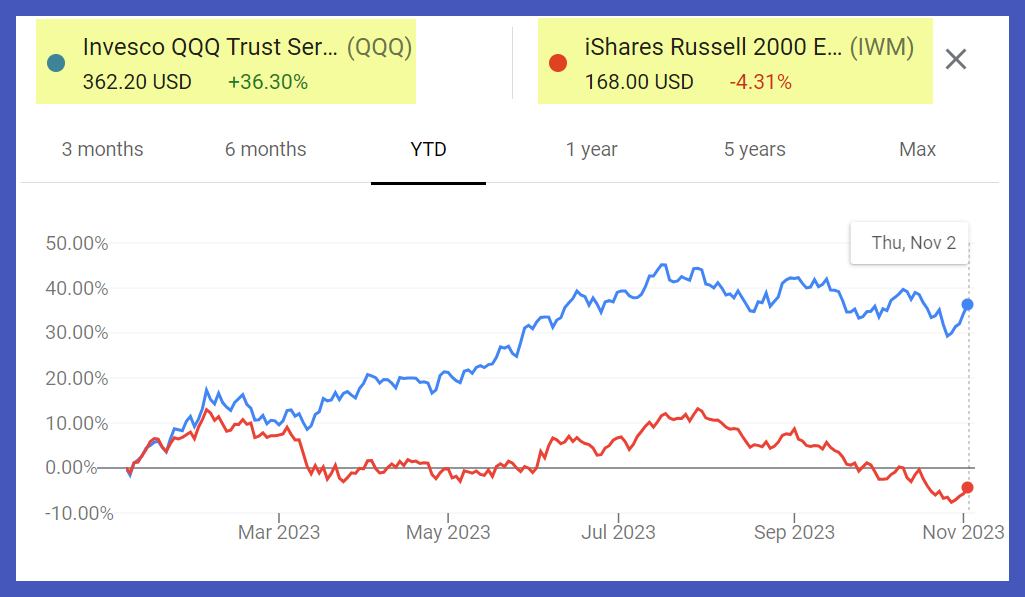

Lately, Big Tech takes a turn in the lead among equity sectors. The QQQ groups all the biggest Nasdaq 100 names together. It has vaulted higher by 36% this year. That ETF is dominated by the oligopolies of Tech: Apple, Microsoft, Amazon, etc.

In contrast, the IWM ticker represents the Russell 2000 index of small to medium-sized firms. Most of these listings are not household names, and nearly all of them are domestically-focused here in the US.

Note this chasm — the stark year-to-date performance divergence, with Small Cap IWM falling 4% this year (the line in red):

Capital smartly deploys to the names benefitting from a crony-capitalist business world of “winner-take-all.”

What policies elevate the mega-caps, while punishing Main St. and smaller enterprises?

First, soaring inflation presents a more intense hurdle to small firms compared to large. For example, almost all resource-producing companies are massive, due to the necessities of scale. Most small businesses, conversely, consume those resources. The small Hispanic-owned lawn business struggling to meet payroll, for example, acutely suffers the pains of sustained high gasoline prices.

Second, the stifling regulatory environment created by Biden and Washington always favors the larger, already-successful firms. For example, massive New York banks can afford the legions of lawyers and managers to comply with onerous rules, but not the small community banks.

Third, the decades-long march toward globalism prioritizes the C-suites of multinationals over the start-ups of Main St. Offshoring production, and importing millions of immigrant workers into America – both legal and illegal – lowers real wages here while sending outsize gains to the global players, the kinds of companies that comprise the QQQ ticker.

As awful as “Bidenomics” has been, we must recognize that this globalist preference for Big Business has prevailed for decades in America, and especially since China was allowed into the World Trade Organization in 2001 on terms that were amazingly friendly to Beijing and punishing to American producers and workers.

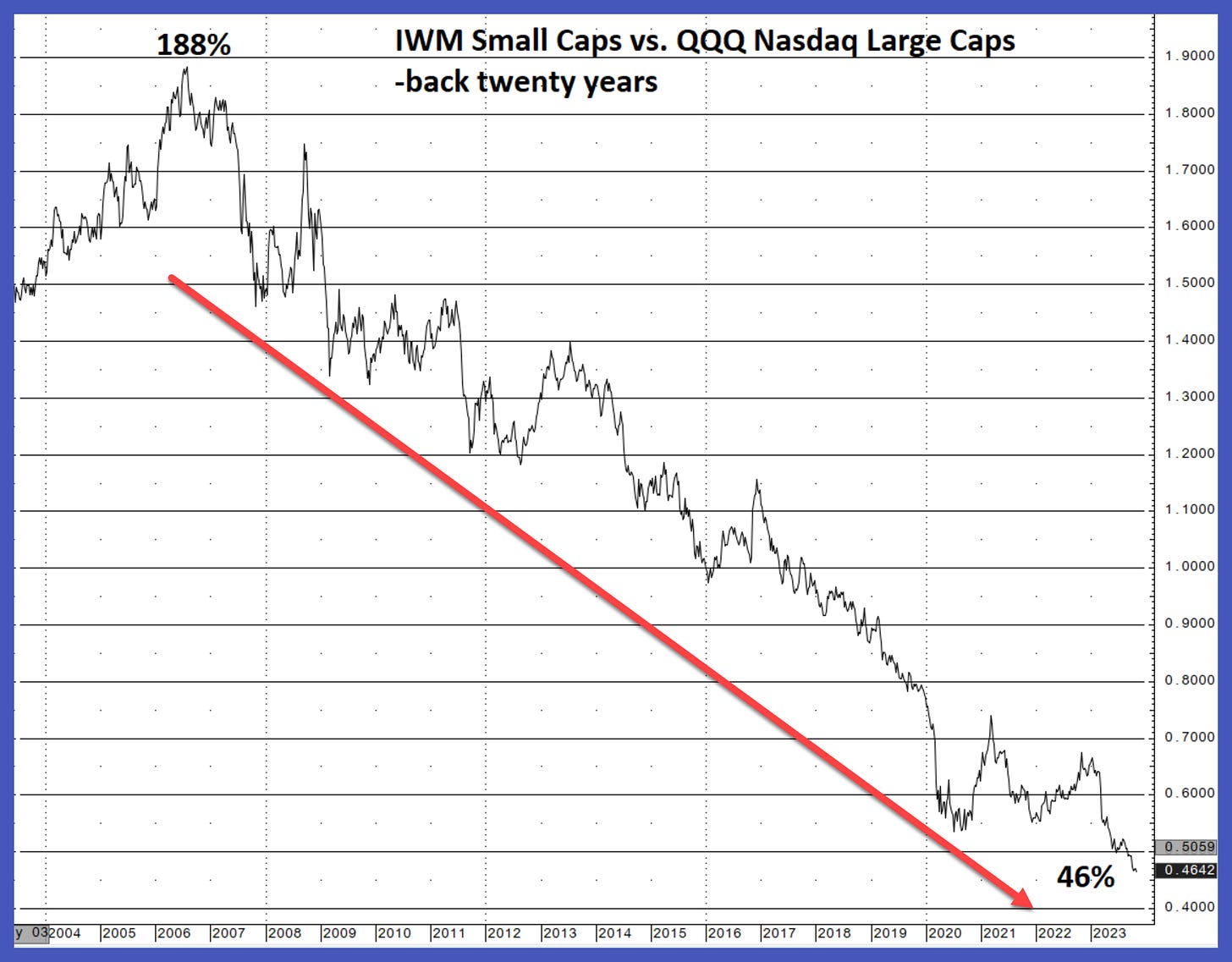

Here is the Small Caps vs. Large Tech on a percentage basis, the IWM/QQQ spread, going back two decades:

As the above chart displays, Main St. languishes compared to Big Business, and for years.

Now, Biden’s misbegotten policies materially exacerbate this trend, especially via his created inflation crisis. Not surprisingly, small business owner-operators take notice, and convey persistent pessimism under Biden, as reflected by the National Federation of Independent Business.

The first arrow on this NFIB chart shows how Biden inherited a lot of upward momentum as America aggressively reopened following the 2020 lockdowns. Then, once Biden, McConnell, and Pelosi took control and their inflation conflagration exploded, small business confidence tanked. In fact, this NFIB index hit a one decade low this year.

Into 2024, American voters can decide to change this dismal trajectory. We can smash punishing inflation through fully unleashing American energy again and reining-in exorbitant Washington borrowing and spending. America must repel predatory foreign trade, especially from China, with sensible protections and tariffs with teeth. Securing America’s border and reducing work visas will protect the wages of citizens, prioritizing American workers over the profit margins of multinationals.

Moreover, breaking the dominance of Big Business will also help our society outside of economic benefits. Given the melding of large corporations with the secular humanist Left in politics, the long-term health of our society demands that we return to vibrant entrepreneurship and principles of economic subsidiarity. Let’s create a society of flourishing small enterprise rather than submit to the oligarchic economic and cultural abuses of Big Business.