Biden's Punishing Inflation Persists

Prices are not “going down.” In many key areas of life, inflation reignites. See the data.

Voters reject Biden’s crushing inflation, and increasingly long for the prosperous days of Trump. Recent polling proves this point.

My populist laborer group, the League of American Workers, recently commissioned a survey of likely voters in battleground Michigan, and found huge advantages for Trump on economic issues. Overall, when asked: “were you better off under Trump or Biden,” the former president enjoys a big 11 point advantage, 49-38%. The gap grows far larger for working-class constituencies, who suffer disproportionately from the ravages of inflation. Blue-collar white men in Michigan, for example, report a massive 63-24% advantage for Trump on their personal finances.

The latest economic numbers show that this anxiety is based in the cold hard facts of stubborn inflation.

Specifically, this week’s new CPI (Consumer Price Index) report validates the reality already experienced by struggling workers: life is very expensive…and it’s not getting any better.

In this latest disappointing report, shelter and energy price increases accounted for more than half (60%) of the total inflation surge.

These items are not luxury, discretionary purchases, but rather necessities of life! Let’s look at some of the damning details for these categories.

Regarding housing, Americans see their standard of living decline materially, because housing affordability plunges to the worst levels ever, per Goldman Sachs analysis. Due to Biden’s sky-high interest rates and sustained high home prices, Americans can now only afford smaller homes, after decades of rising home sizes. Even the Jeff Bezos Washington Post concedes this point, observing that “major homebuilders are prioritizing narrower houses with fewer doors, windows, and cabinets.”

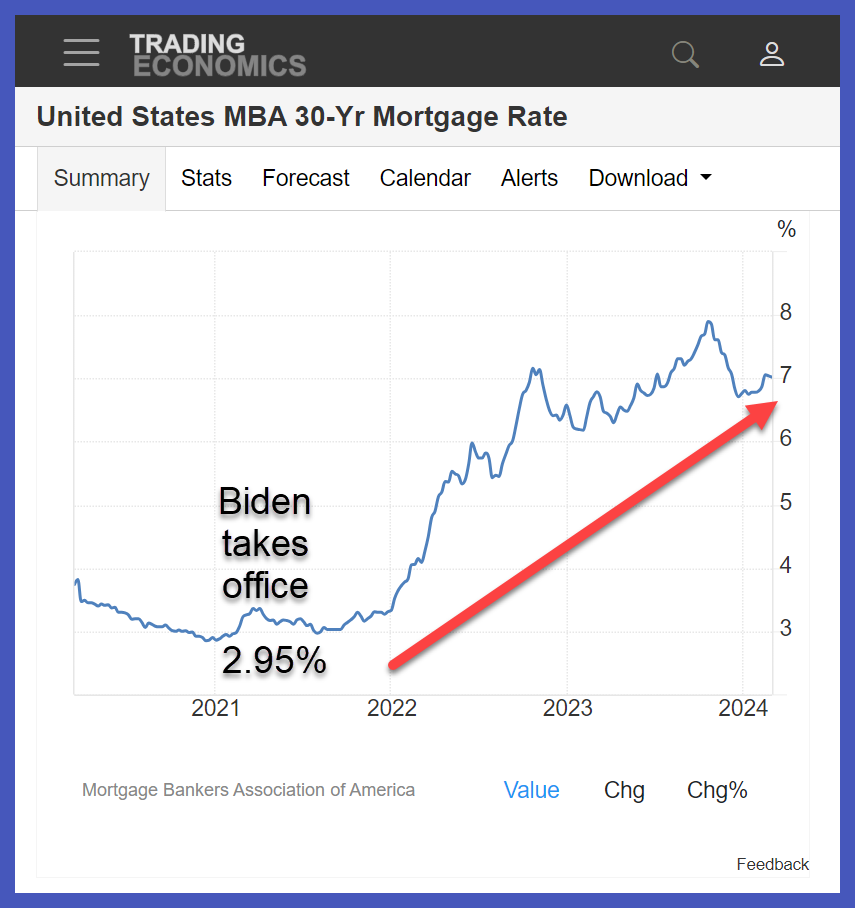

As Biden’s exorbitant spending sends interest rates rocketing higher, mortgage rates have more than doubled on his watch. As shown here, under Biden, mortgage rates moved from 2.95% when he took office to over 7% today, for a 30 Year Fixed loan.

Of course, those soaring mortgage rates bleed directly into higher lease rates for renters, too. Here is a look at the dollar amounts demanded to rent a median apartment in America, tracked by Redfin. As the chart displays, the median rate has gone from $1,640/month when Biden took office to nearly $2,000/month, a 21% leap higher in rents.

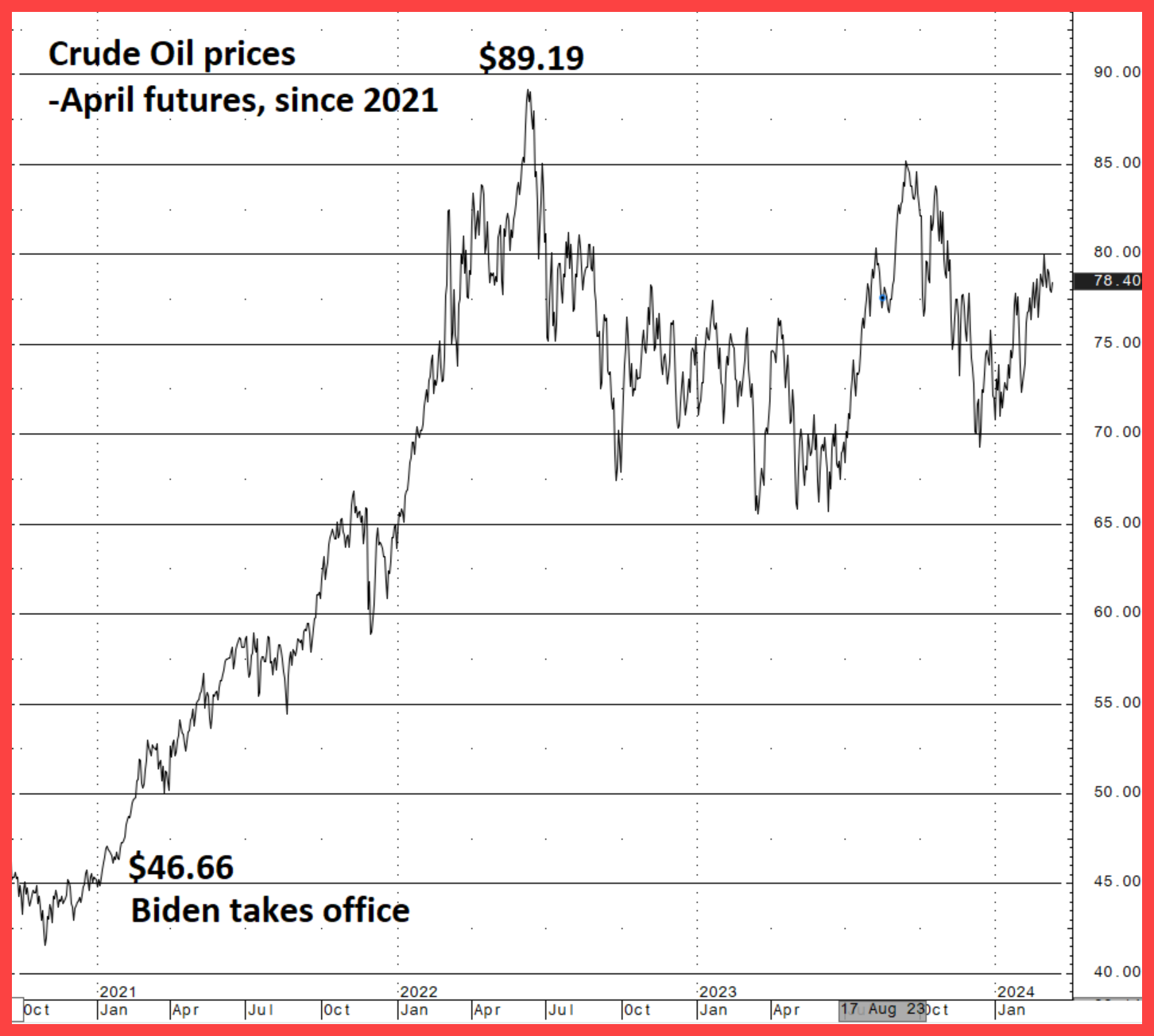

Turning to energy, Biden literally started his White House tenure with aggressive actions attacking American energy, from pipelines, to drilling permits, to radical “green New Deal” regulations usurping the affordability of fossil fuels. As a consequence, energy prices have surged higher, despite America being blessed with the strongest overall energy potential in the entire world. Here is a chart of Crude Oil, which moved from $46/barrel to nearly $80/barrel now.

The supposed “working-class Joe” from Scranton sure doesn’t care much about the cost of a gas station visit for struggling moms in places like Scranton.

Of course, Energy prices have fallout for so many other prices in the economy, and especially for food, because growing food requires fertilizers and shipping food requires fuel. According to Biden’s own US Department of Agriculture, the monthly grocery tab for a family of four, on the “thrifty” plan of food frugality, has vaulted higher, from $675/month to $975/month. That extra $300 per month represents a stunning 44% increase at the grocery store for working-class families.

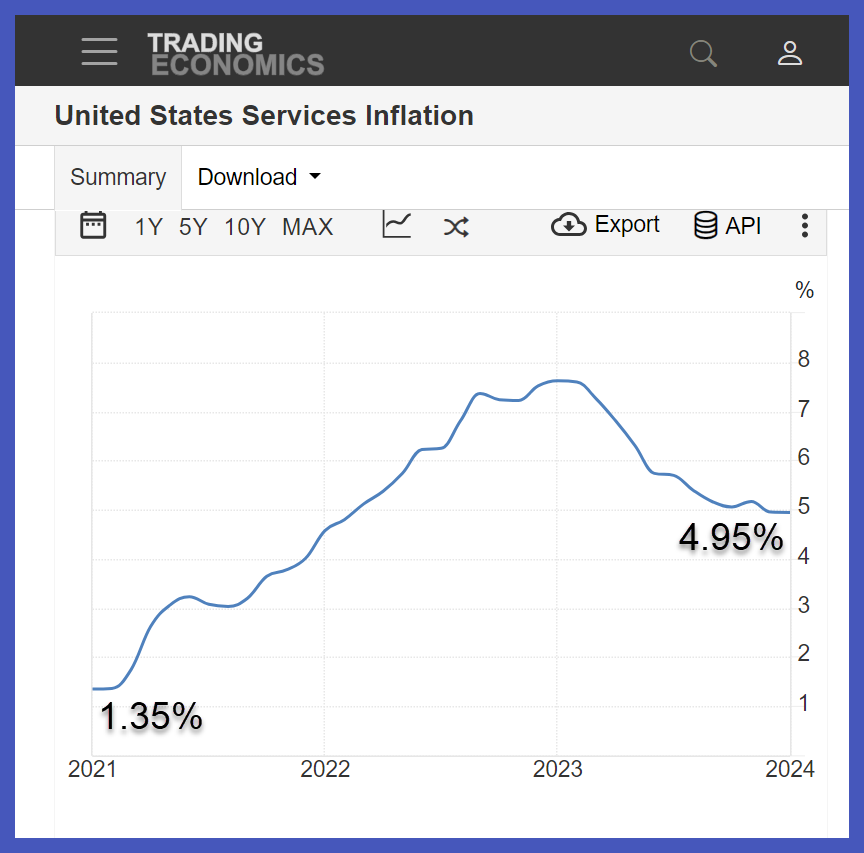

Finally, consider Services Inflation. With Biden’s profligate borrowing and spending, prices for everything surge, not just tangible goods like houses and groceries. Our country is mostly services-based, accounting for 70% of the total economy.

Services inflation is, in most ways, even worse than commodity and goods-based inflation, because it tends to be “stickier.” When prices for services go higher, they almost never retreat, for everything from healthcare to haircuts. Here is a look at punishing Services inflation under Biden, more than tripling.

So, the Biden/Harris administration makes it clear: the inflation beatings will continue until morale improves!

In fact, Joe and Kamala are so indifferent to the inflation pain of America that they just proposed a gargantuan $7 trillion budget. That’s wartime level spending…even though we are not at war.

Americans do feel besieged though – by economic anxiety. Time for a change, time to get back to broad prosperity with higher wages and lower inflation, once our country makes the right choices in November.

Inflation comes in waves. Imagine you are on a beach and the waves are coming in before a storm. The waves of price increases get higher. The price of services does not change as fast as the price of eggs. Another wave increase is automobile insurance; also, not a luxury. Opening up their 2024 bills for car insurance people felt a jolt. A new sector every day factors an increase to a person's budget. Wave after wave we feel like we are drowning.