Has Inflation Actually Peaked?

Legacy media platforms practically beg you to believe the worst of inflation is behind us.

Jim Cramer and other luminaries of the business media boldly proclaim that inflation has peaked. They promise that the inflationary nightmare that presently punishes pocketbooks and crushes spirits across our land, it will soon dissipate. In fact, the legacy media platforms practically beg you to believe the worst of inflation is behind us.

But is that notion true?

Before delving into the economic numbers that point to a continuation of a very dismal path ahead, consider the backdrop of corporate media in America presently. The mavens of the media dutifully act as public relations representatives for Biden and the permanent political class.

Instead of properly acting as fact-finding advocates for the public, the legacy platforms prioritize narrative. Instead of approaching so-called experts with proper skepticism, once respected outlets function as de-facto stenographers, simply regurgitating the pronouncements of Biden, Treasury Secretary Janet Yellen, and Federal Reserve Chairman Jerome Powell.

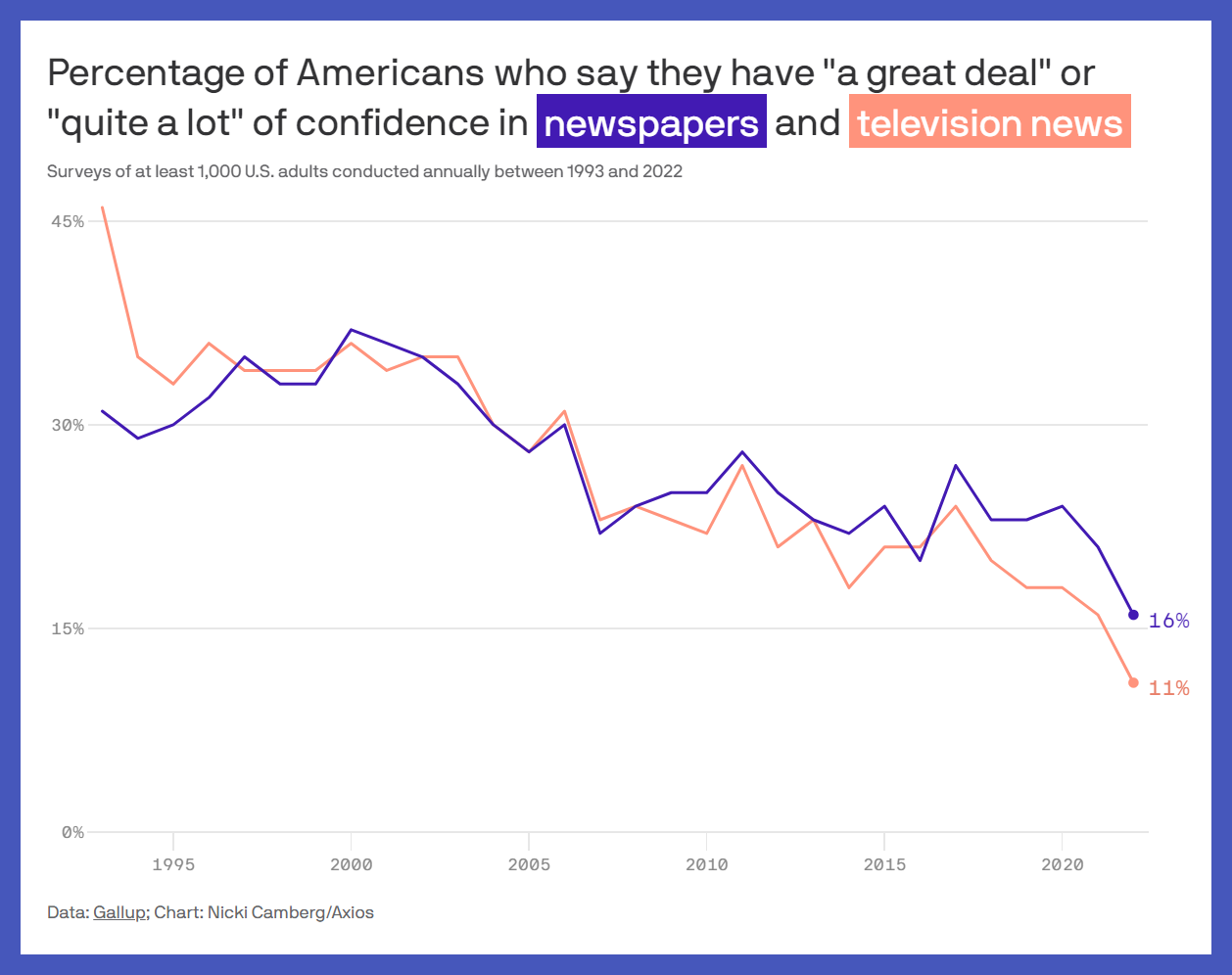

Given this media corruption, no wonder Americans’ overall trust in media collapses to historic new lows, per Gallup Polling:

This meltdown in confidence is warranted, and not just for the political press, but also for financial news as well. For example, the aforementioned Jim Cramer assured Americans last week that the staggering 4-decade new highs on inflation, with CPI surging to 9.1%, marks the summit for this inflationary crisis. CNBC’s headline sought to defang the inflationary monster with its headline: “The Fed Is Winning Against Inflation, Despite Red Hot CPI Number, Jim Cramer Says.”

Well, if Jim Cramer says so!

I guess?

Or, no, not at all…

Let’s look at what Jim Cramer said about inflation just a couple of months ago, back in May when the April data points already proved an alarming acceleration in overall pricing. On May 5th as markets swooned, Cramer declared: “we see too many instances where inflation is receding” as he encouraged investors to buy more stocks.

Well, price is truth. So, how has following that advice panned out? Since the close of May 5th and through last week, the overall market is -7% on the S&P 500. Inflation-sensitive consumer-facing sectors have flailed even worse, with XLY Consumer Discretionary crunched -10% and XRT Retailers sector walloped for -15%.

I point out these losses not to assign blame for poor market calls to Cramer or CNBC. After all, anyone with a long enough record in capital markets makes poor pronouncements. Instead, I highlight these moves in the context of stifling inflation that strangely coincides with a near-universal media effort to dismiss the dangers of that very inflation!

Indeed, corporate media now, in near perfecto unison, channels Kevin Bacon’s famous scene at the end of “Animal House” when he pronounced “all is well” even as the Faber College homecoming parade descended into mayhem.

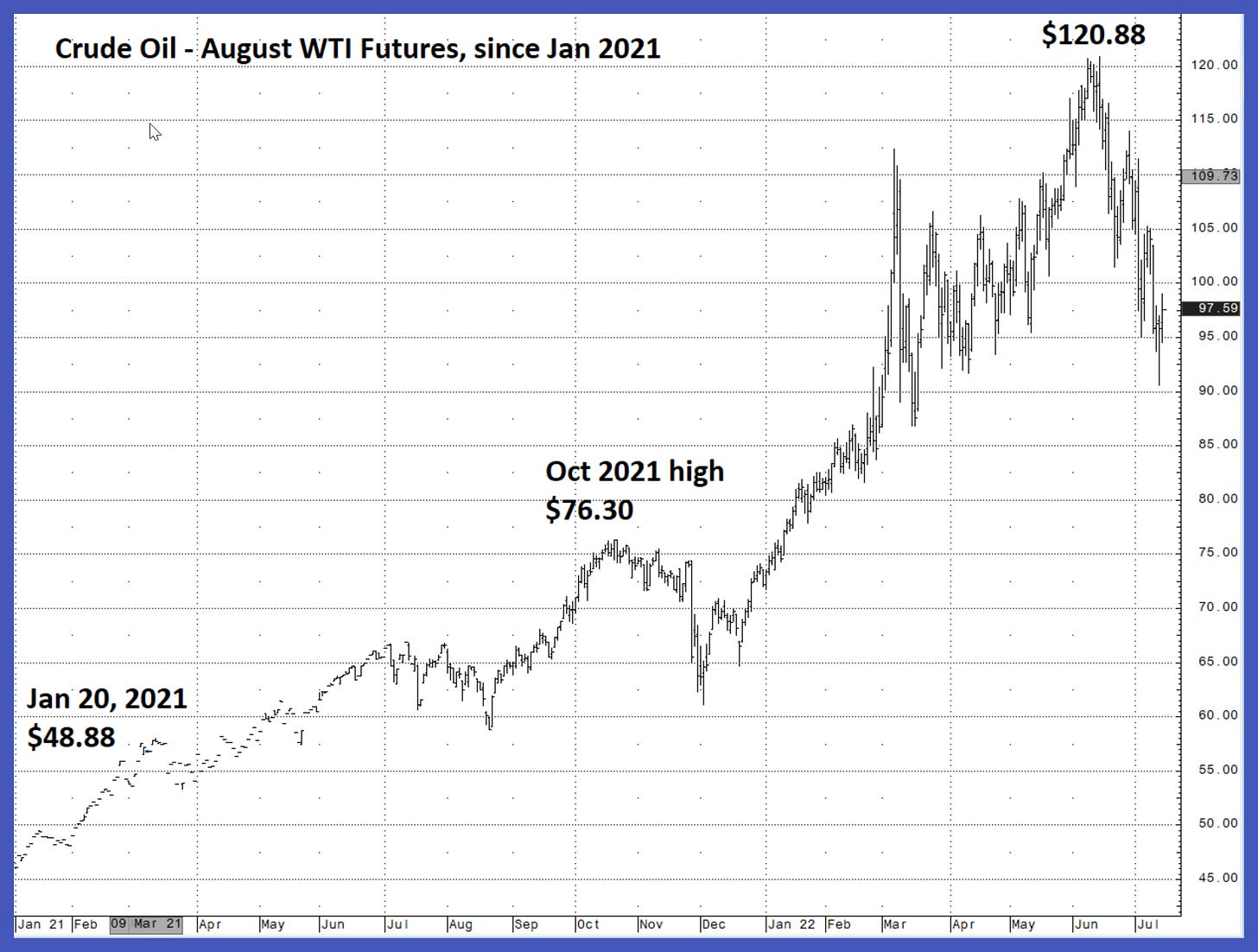

Many analysts correctly point to the sharp decline in recent weeks in some key prices, especially in Crude Oil and Gasoline. But, keep these declines in context. Right now, the benchmark WTI Crude price was still up over $25/barrel in just this year 2022. Looking bigger picture, since Biden took office, Crude Oil rose from $48.88 on Inauguration Day to almost exactly double into Friday’s closing price of $97.59.

But even more importantly, no one can reasonably know that the June highs above $120/barrel mark a lasting peak. Unless someone is clairvoyant, all we know that that $120.88 set the top price for June, and so far for July. What lies ahead? We can make informed predictions, sure. But a few weeks of profit-taking for energy markets should hardly compel this current widespread, arrogant media assurance that the inflation “all-clear” siren sounds.

In fact, see this Oil chart to ascertain the larger perspective of energy’s massive price spikes since Biden took office, including those well before Russia invaded Ukraine:

But even if energy prices do continue to give-back historic gains, what about other inflationary pressures?

For example, last week’s alarming CPI report also detailed that costs for health insurance now rise at an astounding 17% annual pace.

In addition, shelter costs soar. ApartmentList.com reports that “year over year rent growth currently stands at a staggering 14.1%.” That surge in rental rates follows on the record-setting 2021 pace of 17.5%. For comparison, the growth rate for apartment rents during Trump’s term was 1.3%, see the chart below: