Inflation Peaks? Perhaps…But for All the Wrong Reasons

The inflation spiral may abate, but only through a brutal unfolding recession.

For most of 2021 and into 2022, powerbrokers in Washington DC insisted that burgeoning inflation was “transitory.”

Of course, that narrative was a lie. Far from transitory, inflation embeds deeply in the American economy in a systemic fashion. Now, even corrupt entities such as the corporate media and Federal Reserve have finally recognized this undeniable reality.

So, what now lies ahead for inflation?

It is indeed possible, and perhaps likely, that inflation has now peaked. But…for all the wrong reasons.

First, even if the torrid pace of price appreciation slows a bit from the scorching trend of this past summer, a lower rate of inflationary ascent does not in any way mean that actual lower prices beckon. For comparison, even if the speed of the inflationary “rocket ship” slows a bit, the projectile still continues to climb skyward.

Second, any slowing of inflation only results from the material and marked downturn of the economy. Put simply: the inflation spiral may abate, but exclusively because of a brutal unfolding recession.

The economic punches to the gut may cease…but only to be replaced by harsh recessionary kicks to the head.

So, what evidence points to a possible slowing of the inflationary madness?

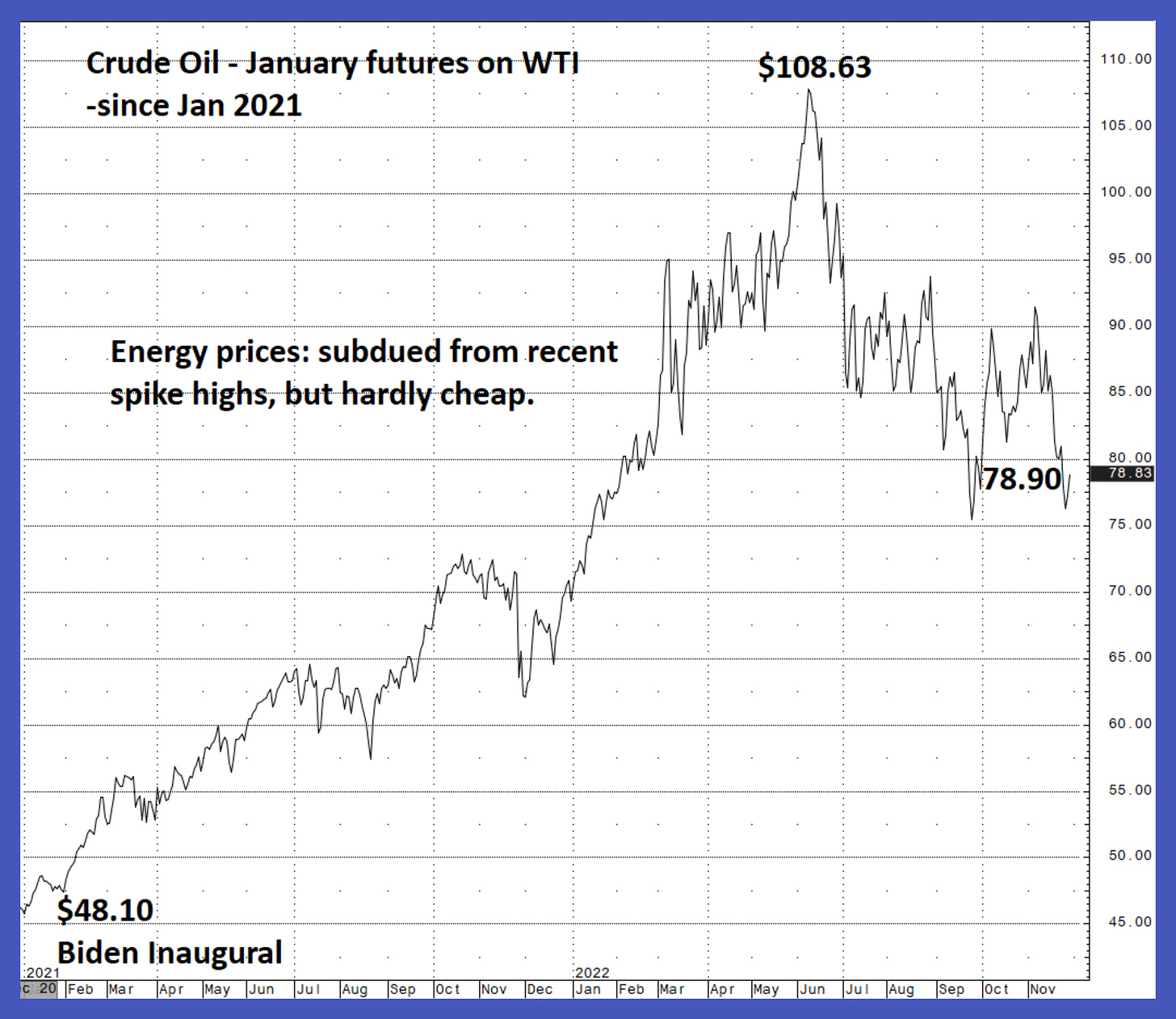

For starters, energy prices have fallen significantly from the super-spike highs of the summer. For example, January futures contracts on the benchmark West Texas Intermediate Crude Oil fell from $108/barrel in June to $78/barrel presently. This discount in Crude Oil has largely coincided with a serious economic slowing in China. For context, though, Crude Oil traded for only $48/barrel on the day Joe Biden took office. So, even with this recent correction, Oil is still up a stunning 62% in the last 22 months under Biden. See the chart:

Other energy prices tell a similar story. Gasoline sells for a national average of $3.54/gallon now. This price seems cheap compared to the recent record June highs at over $5/gallon, but still represents a huge increase over the prevailing $2.37/gallon when Biden took office.

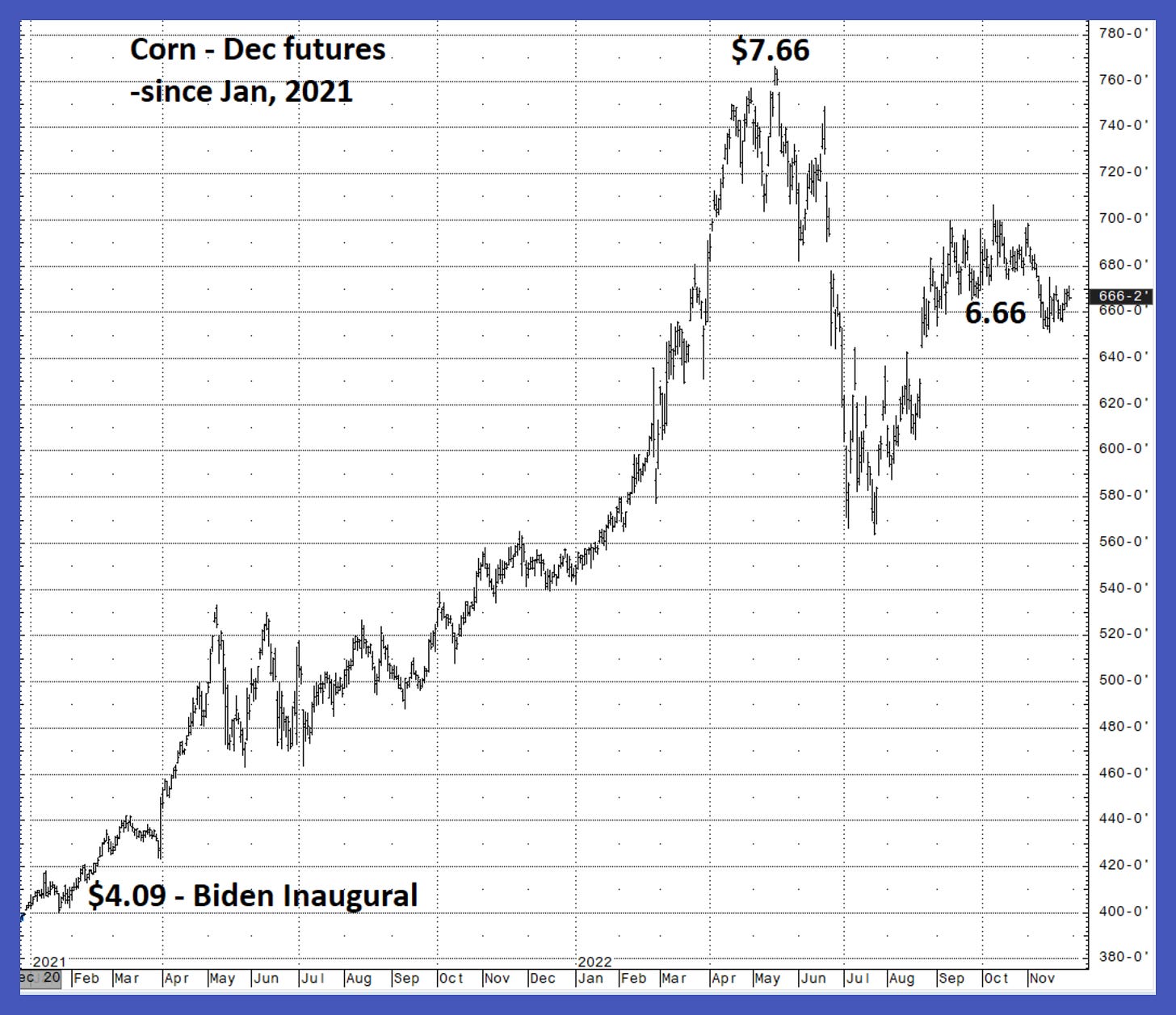

Key food prices show similar trends. Agricultural prices are now well off the summer highs -- but still materially more expensive than just two years ago. Corn futures, for example, trade for $6.66/bushel here, a discount to the recent spike highs above $7.60/bushel, but still far elevated compared to the $4.09/bushel prices on Biden’s inauguration day. See the chart:

This recent concession in input prices flows largely from interest rate increases by the Federal Reserve Bank. After years of super lax, accommodative policy, the Fed finally grasps the gravity of the inflation crisis they themselves helped to create. Chairman Powell and other decision makers at the Fed finally find religion regarding inflation, after previously echoing the ridiculous Biden/Yellen “transitory” canard.

Now, the Fed takes aim with the zeal of converts. For example, St Louis Fed President James Bullard just sternly warned that financial markets are “underestimating the chances of higher rates.” Bullard also advised that the Fed has “a ways to go” on interest rate hikes, predicting that rates would stay elevated all next year and into 2024.

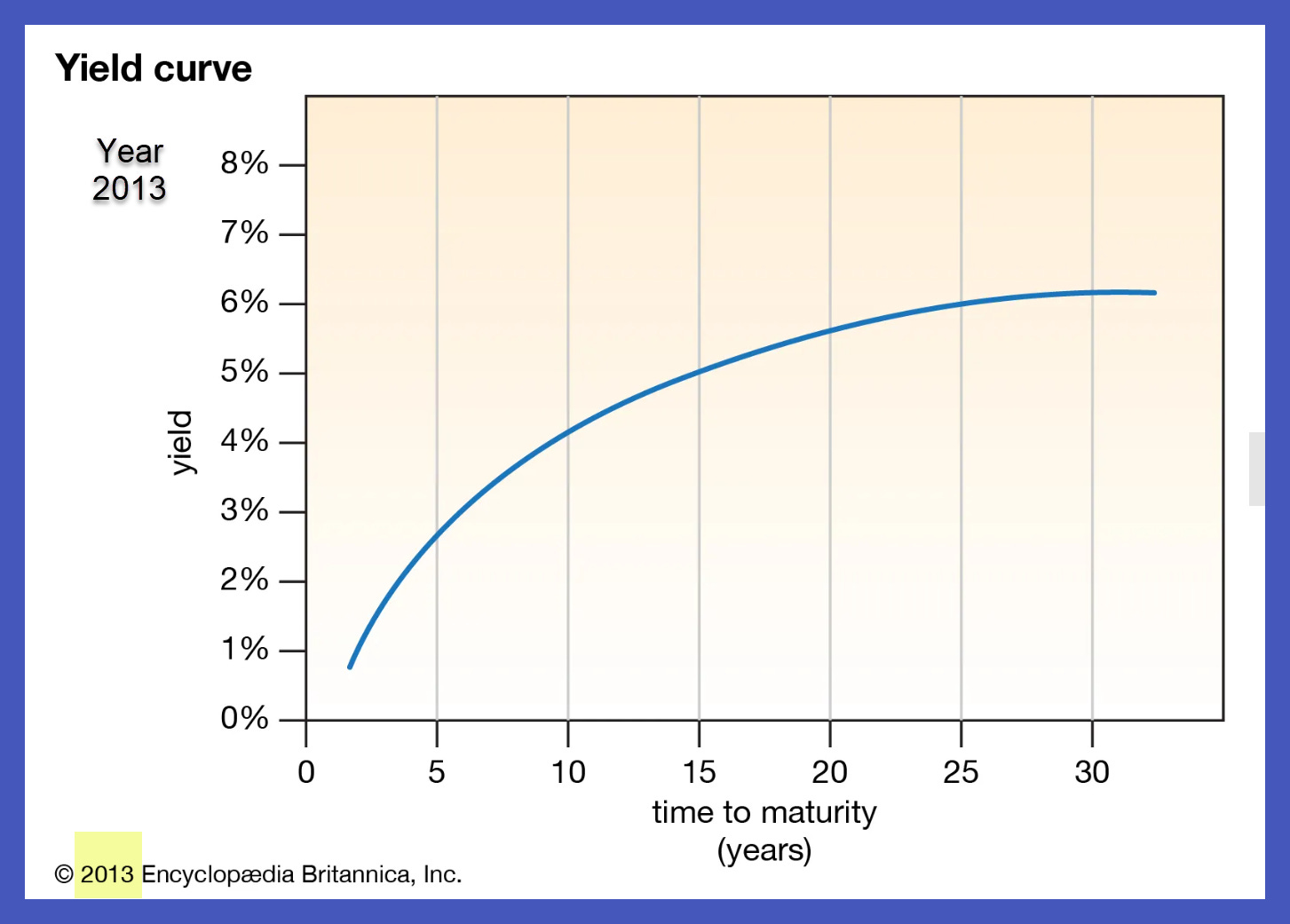

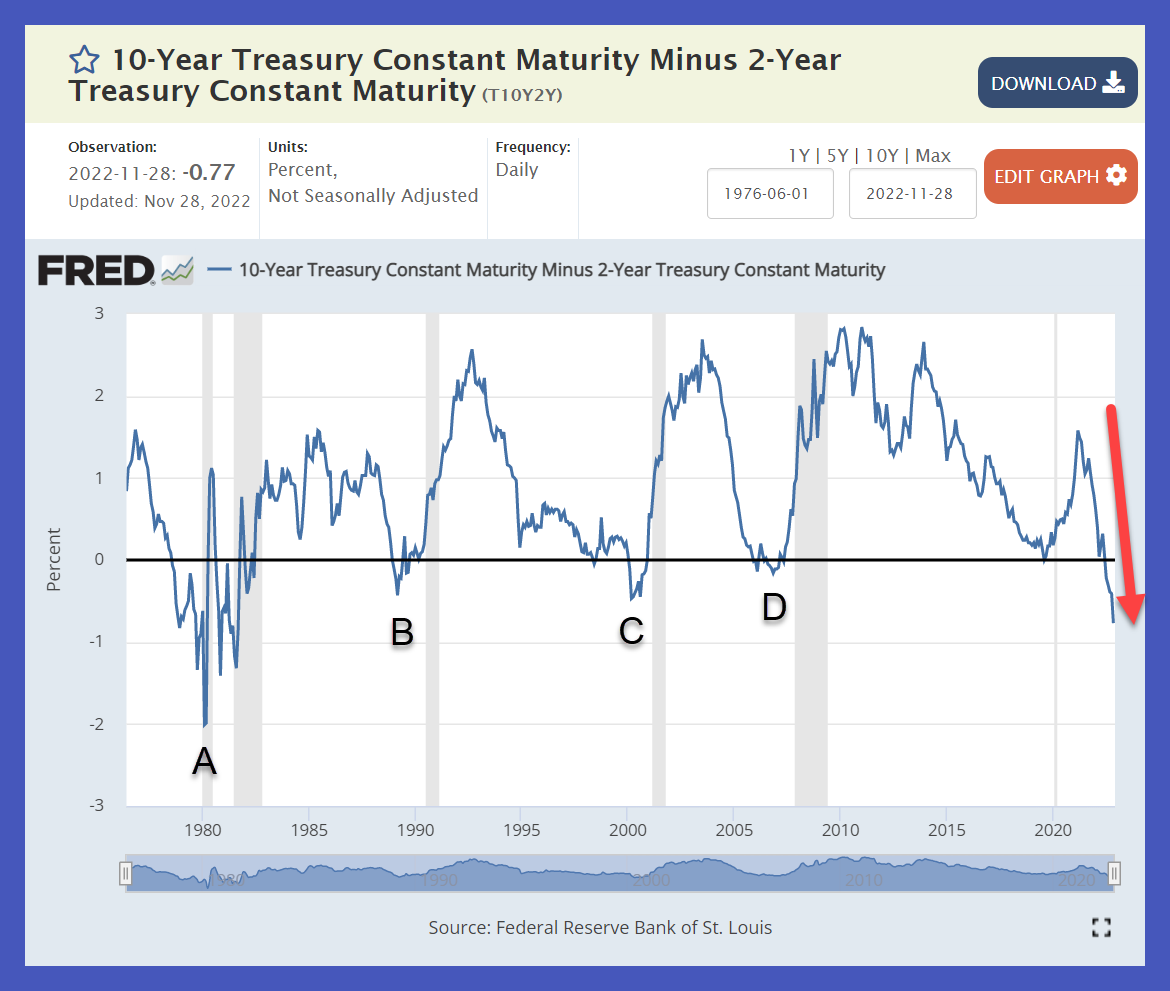

This combination of an aggressively tightening Fed with an economy that tips over into recession produces a rare interest rate scenario known as an inverted yield curve. In normal times, short-term interest rates are lower than longer term, with a gradual slope upward.

For example, here is a historically normal yield curve structure on US Treasury interest rates from 2013:

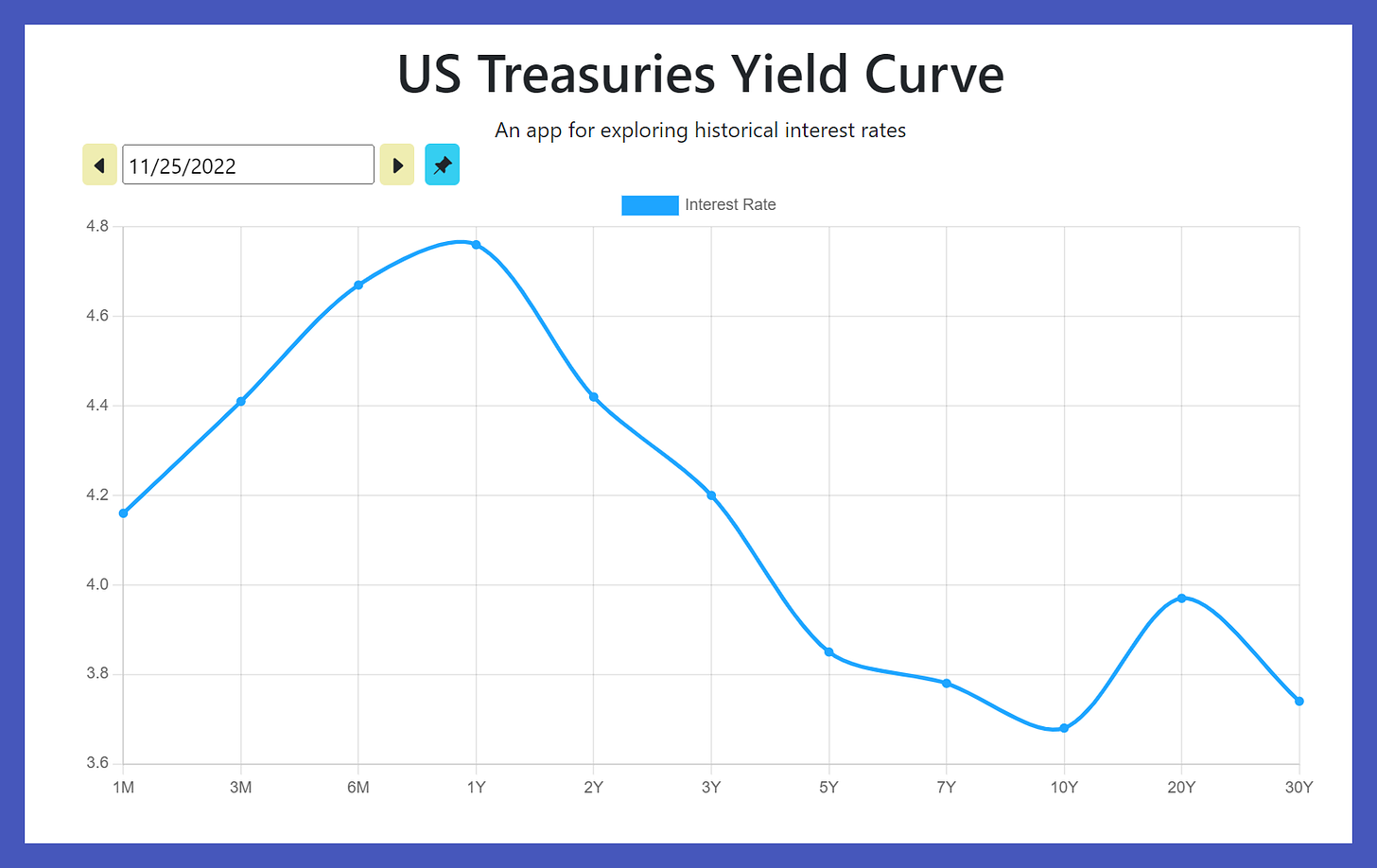

But the present 2022 yield curve looks very different indeed:

This inverted status historically has a near perfect record of predicting or coinciding with recessions, many of them deep and material. This chart shows the 2 year US Treasury vs. the 10 year US Treasury, considered the benchmark yield curve relationship by most traders. The chart extends back to 1976 and shows recession shaded in the vertical gray bars. Prior inversions A-D all correctly presaged significant economic contractions:

Because of this economic contraction, the outlook for the previously strong job market deteriorates intensely. For example, over 120,000 highly paid Tech workers have been laid off so far in 2022. Even worse, this trend of job cuts appears to be in the early stages, as a Price Waterhouse Coopers survey reveals that half of all companies expect headcount reductions in the coming months.

So, harsh economic reality slaps Washington DC policy makers in the face. Biden’s inflationary policies provided the tipping point to burst the bubble of artificially low interest rates. Deficits suddenly matter again, with gusto. The Bond markets globally deliver a profound vote of no confidence for the US economy as presently managed, and significant job losses loom.

There is no easy exit from this mess, no painless way to fight out of this economic corner. A serious recession becomes a near-certainty and only that pain will start to expiate the fiscal sins of past decades.

But the incoming GOP House can start the hard work of economic healing, first by once again unleashing the full power of domestic American energy production. The GOP Speaker and members must pass serious legislation to regain full-spectrum US energy dominance through aggressive permitting of pipelines, land leases, drilling, and fracking – plus the full removal of nonsensical ESG restrictions upon producers.

Biden’s attacks on American energy formed the beginning headwater of his inflationary crisis, and reversing the eco-radicalism represents the most effective first solution. The White House and Senate will surely balk, but the House Republicans must stand ready to deny funding to any and all Biden initiatives unless he liberates American energy.

Then, the patriotic populist movement must address the larger issues of exorbitant borrowing and spending to get growth back to a sustainable path with predictable and contained inflation. For the time being, Americans will tragically continue to grapple with vastly elevated prices for the necessities of life, with that inflation only mollified through a brutal recession.

I have all the respect in the world for you and Steve Bannon.... BUT.... whenever you talk about a few MAGA Republicans fighting to cut spending, I'm thinking one thought: now that it's clear the election process is rigged, how long is the MAGA movement gonna last? I hear Steve talking about lawsuits challenging the recent election results ---- and, in the next breath, telling us they're on hold cuz they're "premature". After that I hear the attorneys who brought the cases haven't any "on the record" assurances from the judge the cases won't be "stale" when they're brought back: "Wow, it's too late now ---the results are final". [I can't believe no one has yet objected to vote counts being ratified by those who are benefitting, politically and financially, from the results --- there are multiple cases labeling such systems a denial of substantive due process when they're instituted within the criminal justice arena].

As long as the voting machines are [beyond] suspect, the courts refuse to hold evidentiary hearings on voter fraud and corrupt dems and repubs keep authoring bills that pay themselves more money, MAGA is gonna get screwed. It's time to stop giving speeches about patriotism, the sacredness of voting and what the minority of MAGA republicans can or can't do with the power of the purse ....and start thinking about new and bolder ways of stopping the foreign influences corrupting our political and judicial system ---

---in other words, it's time to stop fighting the last war ---- the system you're waiting on isn't there.

A Brutal recession is indeed coming.

I have a vision of Joe Biden arms out on the bow of the Titanic shouting 'I'm king of the world'.