The Globalist Failure

Edelman survey details a "massive collapse" of worldwide confidence

As the World Economic Forum gathers in Davos, Switzerland this week, the self-satisfied glitterati of globalism congratulate themselves on the economic, political, and media systems they have created. In the estimation of Klaus Schwab, George Soros, and Bill Gates, the brave new “earth is flat” model serves their prerogatives well.

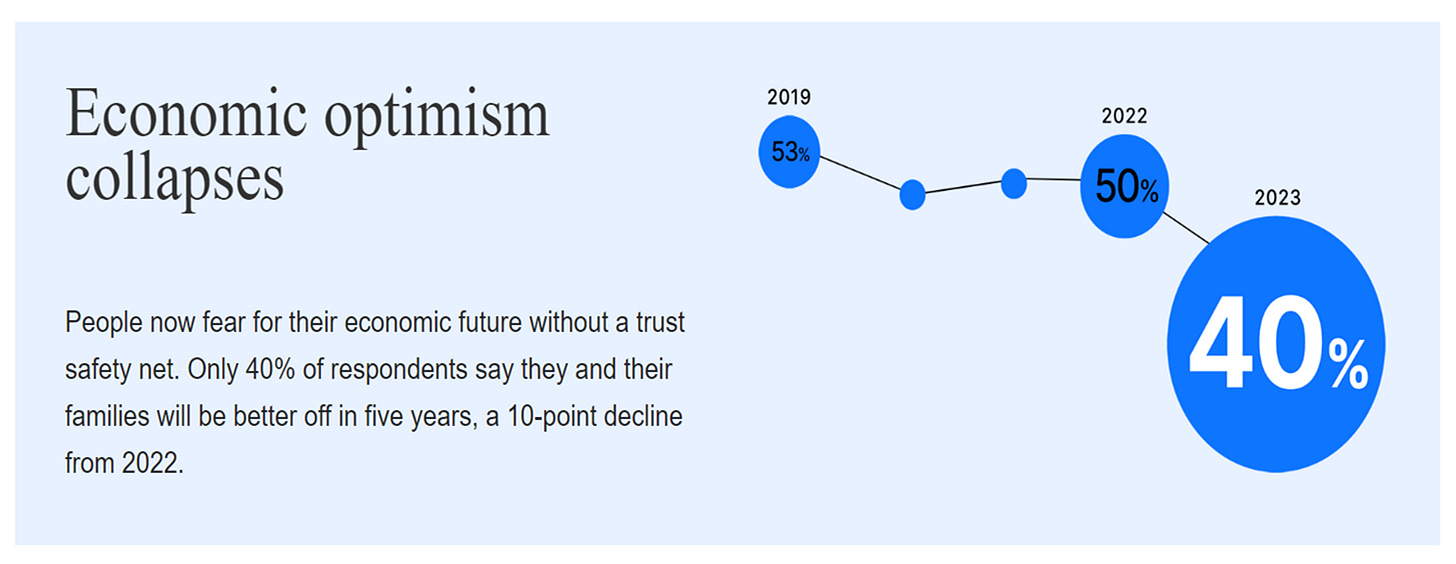

But regular citizens reject this system, the world over. The skepticism of the masses was just quantified by a global survey from communications giant Edelman. That poll found that global economic optimism crashed by 25% since before the Covid virus, and slumps to an all-time low for the study’s history back to the year 2000.

Worldwide only 40% of people believe their family’s economic life will be better in five years. In the US, the optimistic cohort is only 36%. Other advanced nations fared even worse, with Germany showing 15% optimism and Japan only 9%. Half of the 28 countries surveyed showed double digit declines in optimism in just the last year.

The cynicism conveyed by these citizens is, sadly, well-founded in their own financial reality and macro-economic trends. CNBC just published a damning Oxfam study about the concentration of economic power in recent years. Since the beginning of the pandemic, the wealthiest 1% amassed almost 2/3s of all wealth created. To put this financial chasm in dollar terms, for every $1 in wealth earned since 2020 by those the bottom 90%, each billionaire acquired $1.7 million in new assets.

In America, this widening economic disparity emerges as a predictable measure of trust in institutions. Specifically, high earning Americans reported a relatively high 63% level of trust in institutions of government, business, and media. Naturally, the credentialed ruling class beneficiaries approve of their captured organizations. But -- among lower income Americans, the number stands at only 40%. The Edelman survey also reveals a partisan divide with only 23% of Republican voters believing they will be better off in the next five years.

That gloomy forecast among Americans flows a realistic assessment of their own economic predicament in this era of rising prices and slowing economic activity. For example, 35% of all Americans now pile on high interest credit card debt just to afford the basic necessities of life, according to a recent Census Bureau study. Given that the average interest rate credit card interest rate just rose above 19% for the first time in four decades, this new economic quandary points toward further pain in 2023 and beyond. Adding to the strain of stretched budgets and stifling new debt, Americans also confront the dismal reality of 21 straight months of declining Real Wages under Joe Biden. Incomes adjusted for costs of goods and services shatter futility records as Americans work harder to get poorer every month.

No wonder the CEO of Edelman described this current crisis of confidence as an “massive collapse” and “dire” in his interview with Fox Business.