Since 2020, the successive, dismal policy disasters of the Ruling Class already bring significant economic suffering to middle and lower income Americans. Now, these compounding fiascos multiply into new risks that imperil the entire national economy.

Specifically, because of these botched policy flops, commercial real estate threatens the banks and broad economy today in ways unseen since the Great Financial Crisis of 2008-09.

A review of the sequence of these failures reads a bit like an economic version of the Syllabus of Errors. That Vatican encyclical was issued in 1864 by Pope Pius IX. Affectionately known by Romans as “Pio Nono,” the Pontiff railed against the myriad mistakes and heresies of modernity. Channeling the magnificent work of Pio Nono, here is the damning list of economic errors that bring America to this financial precipice:

1. Lockdowns – the unscientific, illogical, and largely illegal lockdowns compelled massive disruptions to America’s social vitality, mental health, and physical well-being. Those abusive restrictions also created ongoing economic harm, especially through decimated supply chains. But America’s de facto dictators like Fauci, Gavin Newsom, and Lori Lightfoot cared little about the lasting harm, and certainly not about the systemic inflation fomented by the gargantuan level of government borrowing and spending to sustain the lockdowns.

2. 2020 BLM Riots – of course, those draconian lockdown orders were conveniently suspended, per actual public health directives from our supposed “expert” betters. Why? Well, as the promised 2020 “summer of love” descended into widespread chaos, burning, and killing, the doctors and health authorities concluded that social justice goals superseded…social distancing. The ensuing carnage of 2020 damaged downtown city centers in lasting, and perhaps permanent, ways. This massive shift ushered in previously unforeseen economic peril.

3. Commercial Real Estate Risks – lockdowns taught employees and companies to manage workflow remotely. Concurrently, the riots transformed downtowns into effective “no go” zones for regular citizens, and the threats of violence persist to this day. Places like downtown San Francisco and the Chicago Loop are largely ghost towns compared to prior eras, even on workdays.

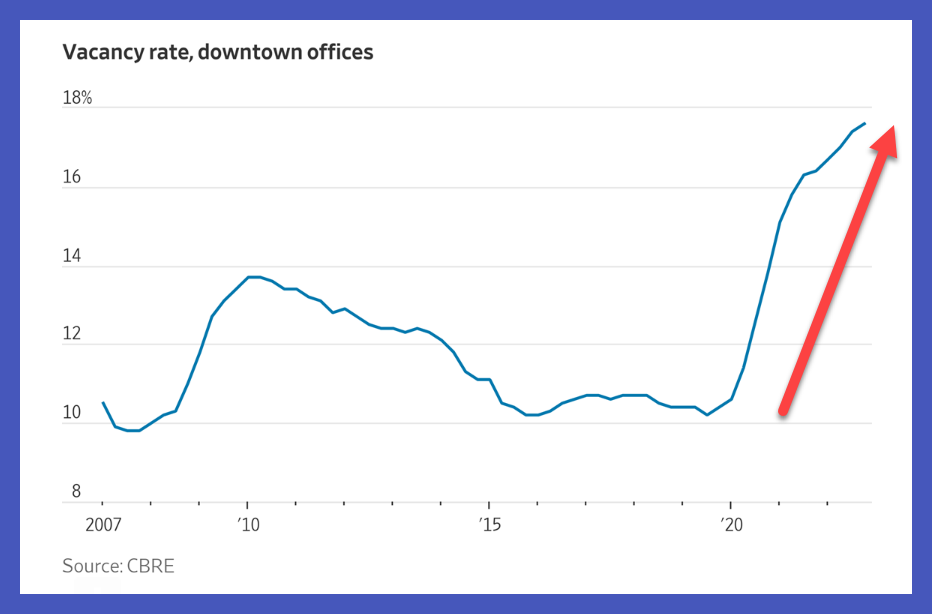

Here is a chart on the alarming rise in vacancy rates for city offices:

As the chart displays, the present spike in vacancy is far worse than even during the 2008-09 financial crisis. Then, the risk concentrated in residential real estate. Now, the primary risks lie on the commercial side.

4. Biden’s Inflation – upon taking office, the new administration took a federal budget that was already far too bloated and ramped it into profligacy overdrive. Biden inherited a V-shaped economic recovery in January of 2021 and he would have actually served America well by just remaining in his basement, per his 2020 campaign routine. Instead, he dialed up the borrowing and spending to sky-high levels. In his first budget, with the help of a lot of Republican collaborators, he spent $3 trillion more than the 2019 pre-virus budget, a 63% increase.

As any sane person could predict, this orgy of waste stoked a giant rise in inflation and a concurrent surge in interest rates. Here is a chart of 10 Year Treasury Yield, the benchmark interest rate for the whole economy.